|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding First Home Mortgage Refinance Rates and Their ImpactFor many homeowners, refinancing a first home mortgage can be a significant financial decision. It involves replacing your existing mortgage with a new one, often with different terms. This article aims to provide insights into how refinance rates work and what factors to consider when exploring your options. What Are Mortgage Refinance Rates?Mortgage refinance rates are the interest rates you pay on your refinanced mortgage. These rates can be fixed or variable, affecting your monthly payments and the overall cost of your loan. Fixed vs. Variable RatesFixed Rates: These rates remain the same throughout the life of the loan. They offer stability and predictability in monthly payments. Variable Rates: Also known as adjustable rates, they can change periodically based on market conditions. They might start lower than fixed rates but can increase over time. Factors Influencing Refinance Rates

Benefits of Refinancing Your First Home Mortgage

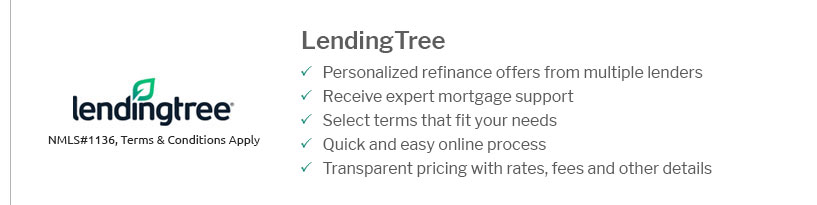

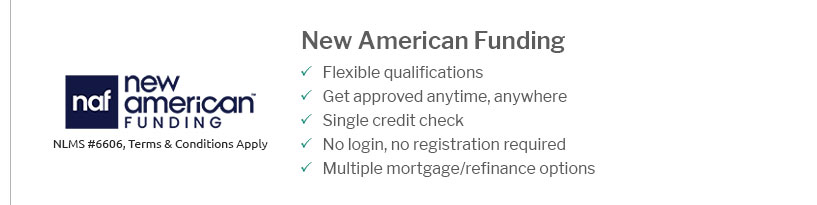

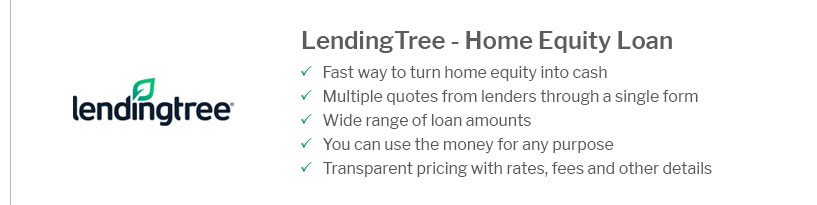

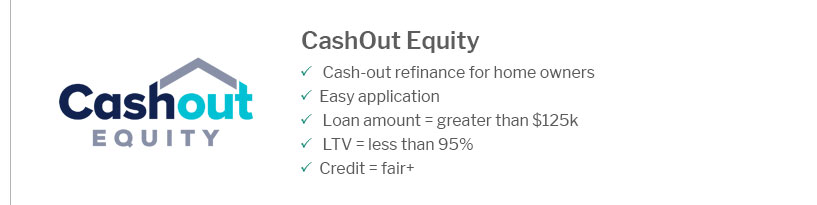

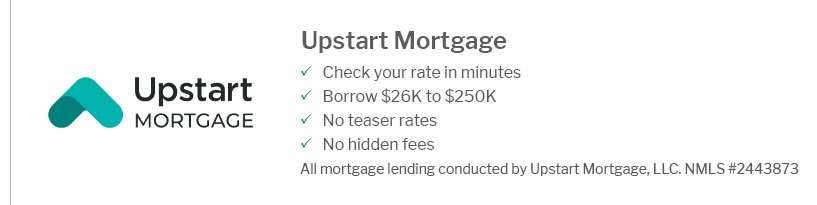

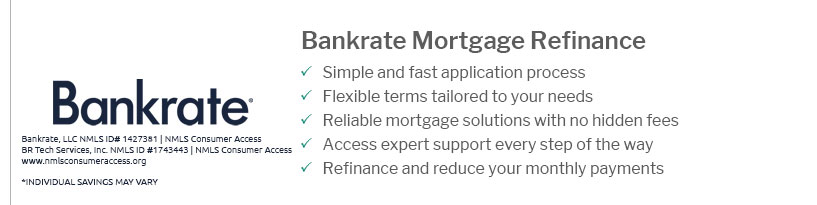

For those looking to refinance, it's crucial to compare options. Consider exploring the highest rated mortgage lenders to find competitive rates and terms. Steps to Refinance Your MortgageEvaluate Your Financial GoalsBefore refinancing, clearly define your financial objectives. Are you looking to lower payments, shorten the loan term, or tap into equity? Research and Compare LendersShop around to find the best rates and terms. A good starting point is to understand what a loan for a house entails and how different lenders can meet your needs. Prepare Required Documentation

FAQ

https://www.bankofamerica.com/mortgage/refinance/

Today's competitive refinance rates ; Rate - 6.750% - 5.875% ; APR - 6.949% - 6.153% ; Points - 0.887 - 0.647 ; Monthly payment - $1,297 - $1,674. https://www.usbank.com/home-loans/refinance/refinance-rates.html

Today's 30-year fixed refinance rates ; Conventional fixed-rate loans - 30-year. 6.625%. 6.799%. $2,971 ; Conforming adjustable-rate mortgage (ARM) loans - 10/6 mo. https://firsthome.com/home-refinancing/

If you have any questions, you can always contact 855.434.7005. Your Loan Officer will review your financial information and determine if refinancing is the ...

|

|---|